Table of Content

But if you buy a home warranty plan, it will typically cover the most significant components of your home system, such as your HVAC, water heater, plumbing, electrical, furnace, and more. It will also cover regular appliances like washers, dryers, refrigerators, and stoves. It is always essential to read the terms of price, manual labor, or material cost of parts before purchasing any home warranty. The warranty companies may not cover all the peripheral prices mentioned in the contract, like the external structures. It can lead to miscommunication between you and the home warranty company. Consider asking for feedback from a friend or a neighbor about their experience with home warranty services.

We also analyze sample contracts from each company to understand specific coverage terms. If you are debating whether or not a home warranty is worth it or not, consider that you can’t predict when your home systems or appliances will fail. A home warranty provides peace of mind if your home’s systems or appliances fail. It also prevents you from spending hours searching for a trusted local contractor. If you are a homeowner or looking to buy a home, you know there are big-ticket items that might cost a fortune to repair or replace. Major home systems like electrical, HVAC, and plumbing will eventually malfunction from regular use.

Are there any waiting periods for a home warranty?

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

One of those scams was 8 Figure Dream Lifestyle, which touted a “proven business model” and told... The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

What Don’t Home Warranties Cover?

A home warranty costs several hundred dollars a year, paid up-front . The plan’s cost varies depending on the property type—single-family detached, condo, townhouse, or duplex—and whether the homeowner purchases a basic or an extended plan. You might choose to purchase your home warranty before summer hits so that your cooling system is covered or before winter arrives so that your heating is covered. This is the case for several seasonal areas of the home such as with pools, roofs and lawn sprinkler systems. Keep in mind the age of a home does not matter when considering if you should purchase a home warranty.

Let them know what appliance is broken and the manufacturer of the unit. To share feedback or ask a question about this article, send a note to our Reviews team at The This Old House Reviews Team is committed to providing comprehensive and unbiased reviews to our readers, and we aim to provide transparency in our review standards and research process. Home warranties also do not cover issues caused by environmental hazards, like fires or flooding, and acts like theft and vandalism. The homeowner may have little or no say in the model or brand of a replacement component, or may not like the job the company-designated contractor does. The improper maintenance clause common to warranties can mean the new homeowner isn’t really protected if something goes wrong and the previous owner hadn’t maintained the system properly.

Top Home Warranty Companies And Average Cost Breakdown

When buying an older home you are responsible for all the maintence the prior owners’ have, or have not done. Check out the service quality of the home warranties and read their reviews. We at the Guides Home Team looked closely at the purchasing process and compiled this guide to buying a home warranty.

However, there are some legitimate reasons that may not make a home warranty worth the cost. Like anything else, investing in a home warranty plan – such as AFC Home Club – has its pros and cons. It’s important for you to carefully weigh these advantages and disadvantages before making any commitments. Some appliances might even be ineligible for coverage if they are too old, in poor condition, incorrectly installed or have not been properly maintained. Now that you know how to buy a home warranty, consider the following providers.

What Is a Home Warranty? Peace of Mind for Home Buyers

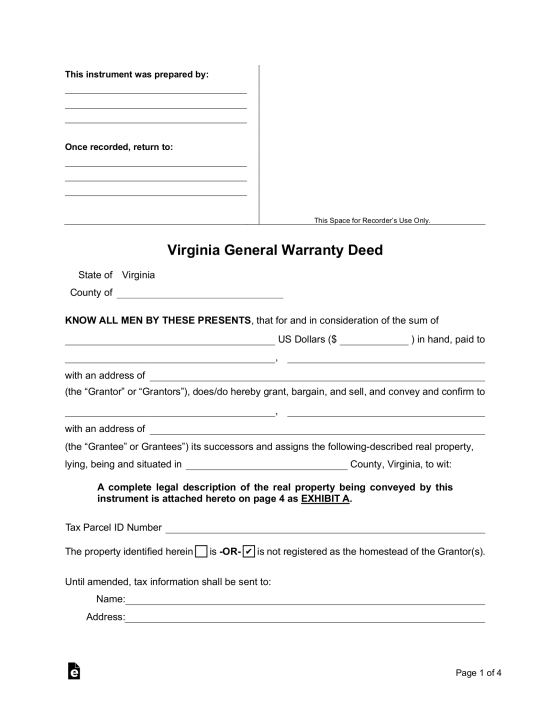

That said, a homeowners insurance coverage may cover a roof replacement. Home warranties are offered via contract for a monthly or annual fee. In the contract terms, you get a fixed service call fee and annual coverage limits for repairs. Service fees and coverage limits vary depending on the company.

We recommend getting a quote from all three providers as they are all highly reputable and feature a wide availability. You’re planning on selling your home and want to entice potential buyers. Samantha is an editor who covers all topics home-related including home improvement and repair.

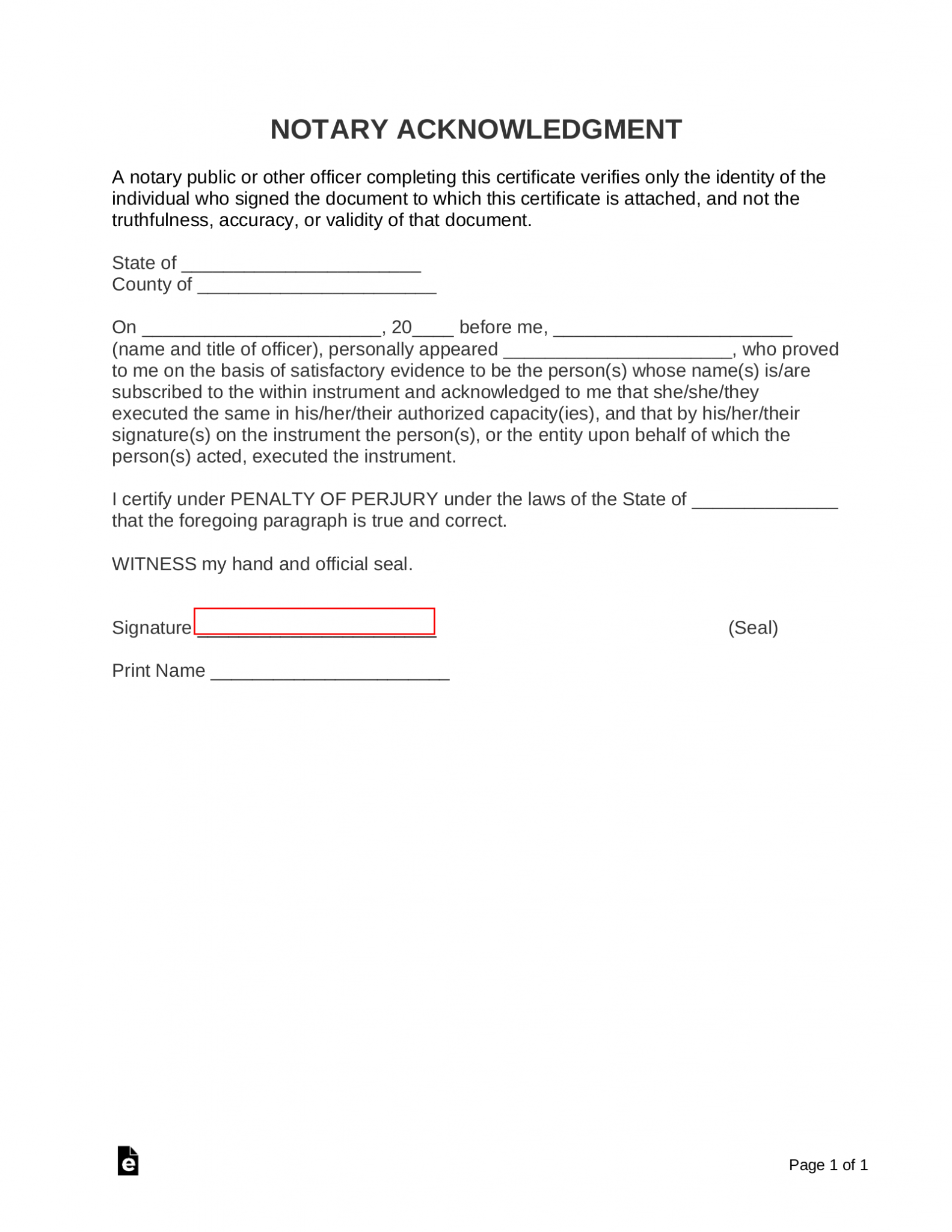

Furthermore, the whole process may be more complicated when a third party is involved than if a homeowner is dealing directly with a contractor. Full BioPete Rathburn is a freelance writer, copy editor, and fact-checker with expertise in economics and personal finance. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

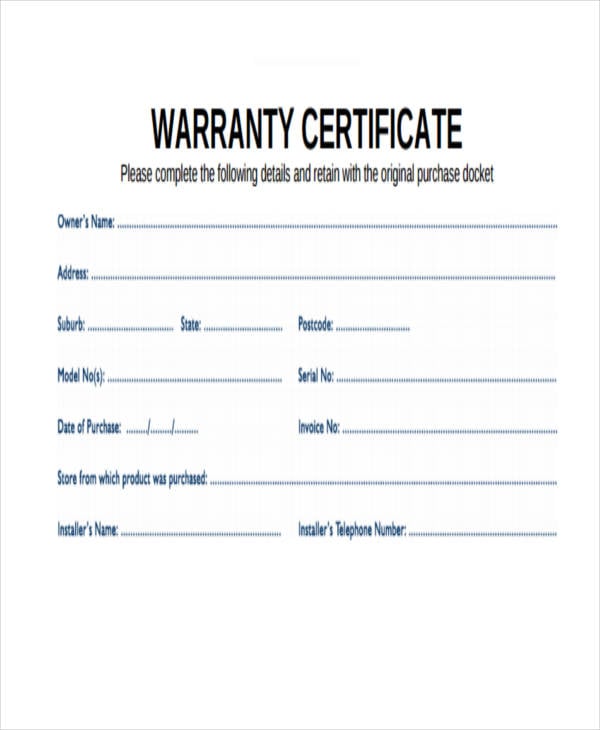

A home warranty is a contract between you and a company that covers repair costs on selected items in and around your home. Home warranties cover breakdowns due to routine wear and tear, but any damage or malfunction due to neglect, misuse, or natural disasters are typically not covered. In many instances, a home warranty company also helps provide a vetted and trustworthy repair technician for you. A home warranty is worth it for homeowners if they seek the peace of mind it provides regarding their home’s appliances and systems. Typically, when purchasing a newly built home, the likelihood you’ll need a home warranty is slim due to the countless already provided warranties.

For a homeowner who doesn’t have an emergency fund or wants to reserve it for other things, a home warranty can act as a buffer. Or, the cost of fixing them wouldn't meet the policy's deductible—the dollar point at which insurance coverage kicks in. A homeowner can include add-ons to a service contract if needed (e.g., coverage for a swimming pool, various appliances, or an external well). If you’re currently living in an older home, you may have experienced your systems and appliances failing after they’ve reached the end of their life span or due to lack of maintenance. There is no guarantee of how long an appliance will last, especially in an older home. By purchasing a home warranty you will protect the systems and appliances in your home when they inevitably fail.

And if repairs are cheap, you simply might not benefit from the extra cost of a service contract. Homeowners insurance covers losses and damage to an owner's residence, furnishings, and other possessions, as well as providing liability protection.. Another common problem is that when a homeowner purchases a used home, it might come with a 10-year-old furnace that the previous owner did not maintain. At that point, no matter how well the new homeowner tries to care for the furnace going forward, the previous neglect can’t be corrected and any damage can’t be undone.

Of course, you want to keep in mind that your home warranty won’t cover appliances and systems that are broken prior to the effective date of the service contract. Therefore, if you really want to be sure you’re protected, sign up for coverage ASAP. They can also purchase it as the sellers agent to provide protection during the sale of the property, something known as listing coverage.